36. Taxation and the reason for low and high (tax revenues).

It 648 should be known that at the beginning of the dynasty, taxation yields a large revenue from small assessments. At the end of the dynasty, taxation yields a small revenue from large assessments.

The reason for this is that when the dynasty follows the ways (sunan) of the religion, it imposes only such taxes as are stipulated by the religious law, such as charity taxes, the land tax, and the poll tax. They mean small assessments, because, as everyone knows, the charity tax on property 649 is low. The same applies to the charity tax on grain and cattle, and also to the poll tax, the land tax, and all other taxes required by the religious law. They have fixed limits that cannot be overstepped.

When the dynasty follows the ways of group feeling and (political) superiority, it necessarily has at first a desert attitude, as has been mentioned before. The desert attitude requires kindness, reverence, humility, respect for the property of other people, and disinclination to appropriate it,650 except in rare instances. Therefore, the individual imposts and assessments, which together constitute the tax revenue, are low. When tax assessments and imposts upon the subjects are low, the latter have the energy and desire to do things. Cultural enterprises grow and increase, because the low taxes bring satisfaction. When cultural enterprises grow, the number of individual imposts and assessments mounts. In consequence, the tax revenue, which is the sum total of (the individual assessments), increases.

When the dynasty continues in power and their rulers follow each other in succession, they become sophisticated. The Bedouin attitude and simplicity lose their significance, and the Bedouin qualities of moderation and restraint disappear. Royal authority with its tyranny, and sedentary culture that stimulates sophistication, make their appearance. The people of the dynasty then acquire qualities of character related to cleverness. Their customs and needs become more varied because of the prosperity and luxury in which they are immersed. As a result, the individual imposts and assessments upon the subjects, agricultural laborers, farmers, and all the other taxpayers, increase. Every individual impost and assessment is greatly increased, in order to obtain a higher tax revenue. Customs duties are placed upon articles of commerce and (levied) at the city gates, as we shall mention later on. 651 Then, gradual increases in the amount of the assessments succeed each other regularly, in correspondence with the gradual increase in the luxury customs and many needs of the dynasty and the spending required in connection with them. Eventually, the taxes will weigh heavily upon the subjects and overburden them. Heavy taxes become an obligation and tradition, because the increases took place gradually, and no one knows specifically who increased them or levied them. They lie upon the subjects like an obligation and tradition.

The assessments increase beyond the limits of equity. The result is that the interest of the subjects in cultural enterprises disappears, since when they compare expenditures and taxes with their income and gain and see the little profit they make, they lose all hope. Therefore, many of them refrain from all cultural activity. The result is that the total tax

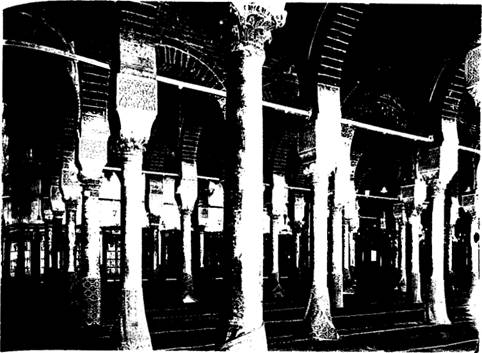

III. The Great Mosque of Tunis

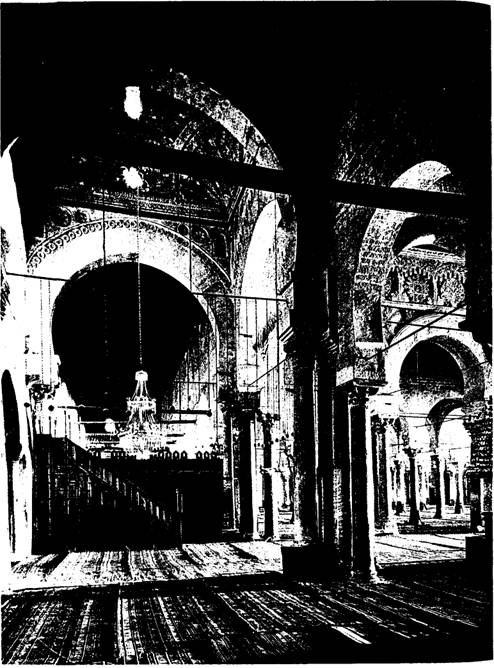

IV. Minbar and Maqsurah of the Great Mosque of al-Qayrawan

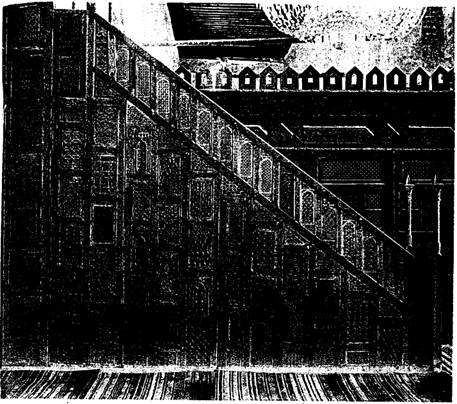

V. Minbar and Maqsurah of the Great Mosque of al-Qayrawan: detail

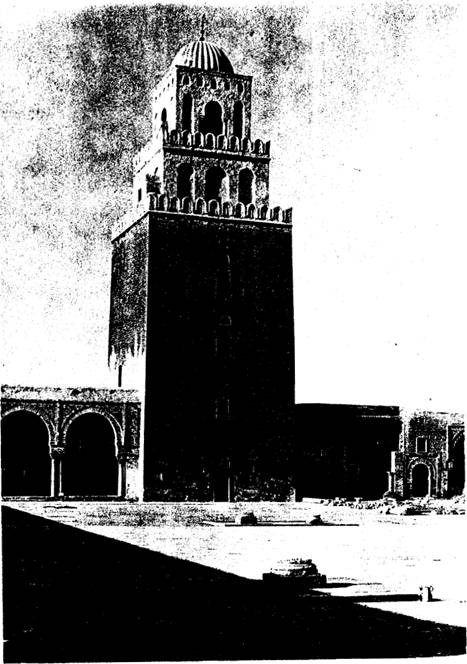

V1. The Minaret of the Great Mosque of al-Qayrawan

revenue goes down, as (the number of) the individual assessments goes down. Often, when the decrease is noticed, the amounts of individual imposts are increased. This is considered a means of compensating for the decrease. Finally, individual imposts and assessments reach their limit. It would be of no avail to increase them further. The costs of all cultural enterprise are now too high, the taxes are too heavy, and the profits anticipated fail to materialize. Thus, the total revenue continues to decrease, while the amounts of individual imposts and assessments continue to increase, because it is believed that such an increase will compensate (for the drop in revenue) in the end. Finally, civilization is destroyed, because the incentive for cultural activity is gone. It is the dynasty that suffers from the situation, because it (is the dynasty that) profits from cultural activity.

If (the reader) understands this, he will realize that the strongest incentive for cultural activity is to lower as much as possible the amounts of individual imposts levied upon persons capable of undertaking cultural enterprises. In this manner, such persons will be psychologically disposed to undertake them, because they can be confident of making a profit from them.

God owns all things.